Technology

The Chip War is escalating, and the EU needs to act quickly

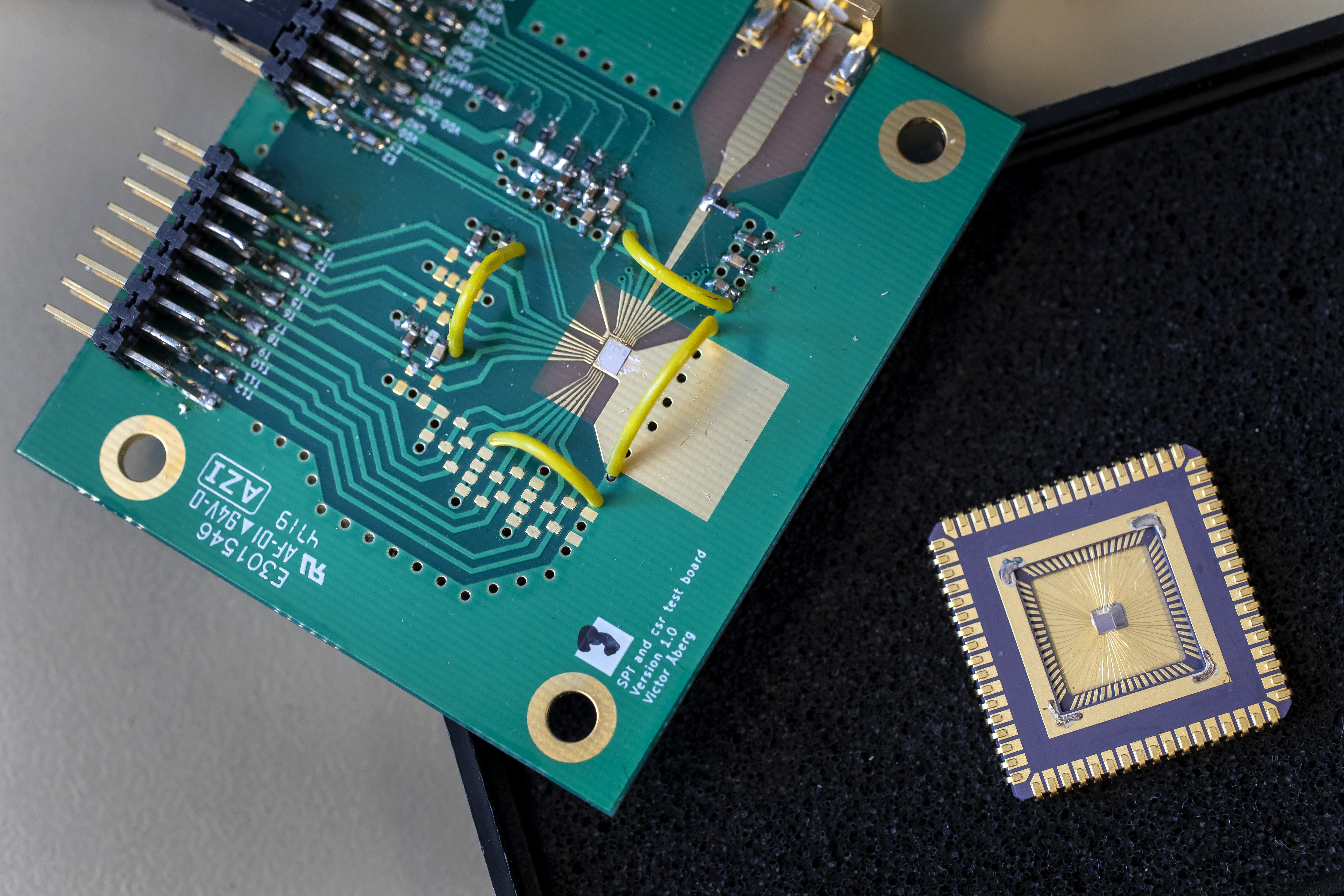

A semiconductor sits between a conductor and an insulator and is commonly used in the development of electronic chips, computing components, and devices.

© picture alliance / TT NEWS AGENCY | Thomas Johansson/TTFrom smartphones and computers to automobiles and warplanes - semiconductor chips have become the backbone and the foundation of new technologies. These chips are at the core of new industrial advancements in various fields, such as: artificial intelligence, quantum computing, nanotechnology, autonomous driving, advanced weapon systems and machine learning. Without these resources, technological production and the creation of new products will not only be difficult, but virtually impossible.

Obtaining thinner, faster and more powerful chips, ultimately, will be the determining factor in many of the great technological, economic and geopolitical clashes of our time. Controlling the manufacturing process of the most advanced semiconductors and cutting-edge chips may be the 21st century equivalent of controlling the oil and natural gas supply in the 20th century. However, unlike fossil fuels, semiconductors cannot be replaced by alternative sources.[1]

Global semiconductor shortage

The public learned about the colossal importance of semiconductors in 2020, with the onset of the pandemic. The shortage of chips and semiconductors caused by the pandemic has disrupted supply chains and manufacturing processes around the world, and some high-tech industries have been completely paralyzed.

During the pandemic, the switch to remote working of the world's population led to a sharp increase in demand for computer equipment and household appliances, which could not be adequately met with sufficient supply, because the production capabilities of the companies and factories represented in this sector were not designed for such apocalyptic scenarios and sky-high demand.

Was the global chip shortage inevitable? - The short answer is yes. Globally, the demand for electronic devices is increasing at a rapid pace every year. The trend is especially growing in developing countries, where the internet coverage area is gradually expanding, and the population is increasingly integrating electronic devices into their daily lives.

With growing demand, supply should also increase, although it should be noted that semiconductor manufacturing is a highly complex field that is, at the same time, extremely capital-intensive. This means that to enter this market, it is necessary to invest a large amount of capital and attract highly skilled labor, which, unfortunately, is in short supply.[2]

Interestingly, unlike other fields, startups are practically non-existent in the semiconductor manufacturing business, as it is almost impossible to compete with the leading companies, such as: TSMC, SMIC, Qualcomm, Intel and Nvidia. What makes the situation worse is the fact that private investors are reluctant to risk their own money in new innovative projects in the semiconductor industry, and because of this, already established large companies gain more power and increase their market share, which ultimately reduces competition and hinders innovation.

The trend of electrification of the auto industry should also be noted. The production of an average vehicle requires about 1,000 semiconductors and almost 150 computer chips, in the case of EVs - the figure is twice that. This indicates that the increase in demand for electric vehicles, in turn, significantly increases the demand for semiconductors. Due to lack of private investment, production capacity is not growing in line with demand - leading to inevitable global shortages. Clearly, the pandemic has been an accelerating factor in the chip shortage, but it's worth noting that the supply-demand mismatch has been a perennial problem. So, in retrospect, due to flawed fundamental factors, the global shortage was inevitable.

World's most important company

The most prominent and important company in the semiconductor sector is the Taiwanese technology giant - Taiwan Semiconductor Manufacturing Company (TSMC).

The relentless rise of TSMC is one of the most impressive and least told chapters in the history of globalization. Founded in 1987, TSMC employs 65,000 people nationwide and controls nearly 60% of the global semiconductor market - giving the company critical economic and geopolitical power. TSMC's importance is not only reflected in its impressive manufacturing capabilities, it is also the 18th most valuable company in the world, its market capitalization is currently 321 billion USD, which is 38% of Taiwan's gross domestic product (GDP). Given these factors, it can be said that TSMC is as important to Taiwan as Aramco is to Saudi Arabia, which once again underlines the similarities between oil and semiconductors.

The colossal importance of TSMC for the global economy is emphasized by the fact that the operation of the world's largest companies, producing computer chips, processors and GPUs, directly depends on the supply of semiconductors by TSMC. Among the companies dependent on the Taiwanese giant are: Apple, Qualcomm, AMD, MediaTek, Nvidia, Sony, Broadcom, Intel and Marvell Tech.[3]

Given these factors, it should come as no surprise that TSMC is one of the highest priority issues for China's foreign policy. In the event of an escalation of geopolitical tensions in the region, TSMC's production process could be disrupted or even halted, which would have a devastating effect on the global supply chain. It should be noted that limiting TSMC's production is not in China's national interest either, as it would damage its own economy too. Given this fact, TSMC acts as a kind of deterrent. However, it should be noted that conflict in the region is not necessary to limit TSMC's exports - a naval blockade would be sufficient to significantly limit TSMC’s exports to the global market, which is currently a significant risk for the West

The direct connection between national security and semiconductors is fairly easy to see. As already mentioned, without this resource, it is impossible to produce modern military equipment and weapons, and this tremendous geopolitical power is currently concentrated in the region of Asia.[4]

It should also be noted that China is actively trying to gain technological independence from the West and Taiwan. The government subsidizes a number of state programs to boost local production and eliminate supply chain vulnerabilities. In the face of the Chinese government's actions, the EU refrains from reacting, allowing China to prepare sufficiently for the worst-case scenario, which in turn significantly increases risks for the West.

Big geopolitical actors are quite aware of this reality and they adjust their policies accordingly. For instance recently, the German government blocked prospective Chinese investment in two domestic semiconductor producers (Elmos and ERS) after concerns over national security and the flow of sensitive technological know-how to Beijing.[5]

The White House has long been concerned that NATO's dependency on TSMC could put its defense industry at significant risk. Now Washington’s desire to slow down China in its pursuit of technology leadership, and fears that Beijing might seize Taiwan by force, are all catalyzing efforts to increase semiconductor manufacturing at home and to achieve self-sufficiency. Other geopolitical powers, such as the EU, Japan, Singapore and India are also making similar efforts.

For years, Washington and Beijing have been engaged in an intense rivalry for technological dominance.[6] The US has never shied away from imposing tariffs or export controls in order to hamper China's growing high-tech sector and military.

Days before the start of the National Congress of China, the US unilaterally announced new restrictions on the export of advanced chips, semiconductor equipment and related components to China. Washington has decided to starve its Asian rival of the technology used for next-generation quantum computing, A.I., and military equipment.[7]

As the global semiconductor fight intensifies, there are several important considerations for the EU. The new aggressive strategy of Washington, coupled with their pledge for 52 billion USD in funding available for domestic chip manufacturers, could completely sideline the EU's efforts to excel its own semiconductor manufacturing industry.

Currently, semiconductor design and manufacturing is dominated by Taiwan, South Korea and China. Recently, the European Commission put forward the "EU Chips Act" as a way to address the shortages. This plan aims to levy billions of euros to scale-up production facilities and to induce the industry to focus on the development and manufacturing of the most high-end, cutting-edge, specialist semiconductors and chips, rather than commodity products. Public funding for the "Chips Act" will amount to 11 billion euro up to 2030, and also, the EU hopes to pull in a further 32 billion euro in private investment.

Unfortunately, the EU cannot compete with Asia in semiconductor manufacturing, and rather than investing in production facilities, the money would better be spent on research and development (R&D). That would allow European companies to specialize in high value areas of the semiconductor chain, like design and software. The most realistic goal for the EU would be to strengthen the advantages it already has. The EU is a front-runner in cutting-edge design and in equipment manufacturing, and the goal of the Commission should be to maintain this leading position. China is pouring billions every year into building this critical advantage, and if it succeeds, both key parts of the supply chain – manufacturing and design – will shift to the Asian region.[8]

Even if the Commission really wants to focus on production, it should be on increasing the manufacturing capacities on the lower-end, such as semiconductors and chips currently used in the household appliances and automotive industries.

As for the supply chain, the only solution is diversification. The EU should not allow itself to become critically dependent on one country or region, as it turned out to be with Russian natural gas, as we can clearly see the bitter experience of this example.

Brussels' quiet call for fair market competition is being lost in the noise. The "European Chips Act" still remains only on paper.[9] The semiconductor industry is clearly becoming one of the most active battlefields of geopolitical rivalry. Unfortunately, sanctions, subsidies, protectionism and state funding will be the name of the game and the EU must be prepared. European leaders clearly need to increase their commitments in support of the sector with such tremendous strategic importance.

The Russia-Ukraine war made it clear that if the geopolitical situation escalates, the adversaries will not hesitate to abuse all strategic advantages to attack the European Union. Unlike oil and natural gas, semiconductors are irreplaceable, and without this resource the EU faces the dark ages.

[1] Chip War: The Fight for the World's Most Critical Technology; Chris Miller, 2022.

[2] “The Global Semiconductor Chip Shortage: Causes, Implications, and Potential Remedies”; Adel Elomri, M. Wassen, L. Kerbache, 2022.

URL: https://www.sciencedirect.com/science/article/pii/S2405896322017293

[3] “TSMC: the Taiwanese chipmaker caught up in the tech cold war”; Kathrin Hille, D. Sevastopulo, 2022.

URL: https://www.ft.com/content/bae9756a-3bce-4595-b6c9-8082fd735aa0

[4] “Real Winner in U.S.-China Chip War Won’t Be Either Side”; Jacky Wong, D. Gallagher, 2022.

URL: https://www.wsj.com/articles/real-winner-in-u-s-china-chip-war-wont-be-either-side-11591265619

[5] “Germany blocks Chinese stake in two chipmakers over security concerns”; Andreas Rinke, M. Murray, 2022. URL: https://www.reuters.com/markets/deals/germany-block-chinese-takeover-semiconductor-firm-ers-electronic-handelsblatt-2022-11-09/

[6] “How China's pushback against US semiconductor restrictions could play out”; Manoj Joshi, 2022.

URL: https://economictimes.indiatimes.com/opinion/et-commentary/how-chinas-pushback-against-us-semiconductor-restrictions-could-play-out/articleshow/95129568.cms

[7] “Tech war: China’s semiconductor ambitions face moment of reckoning as Washington launches all-out siege”; Che Pan, 2022.

URL: https://www.scmp.com/tech/tech-war/article/3197626/tech-war-chinas-semiconductor-ambitions-face-moment-reckoning-washington-launches-all-out-siege

[8] “EU semiconductor strategy needs more emphasis on research”; Aude van den Hove, 2022.

URL:https://sciencebusiness.net/news/eu-semiconductor-strategy-needs-more-emphasis-research

[9] “Where the US-China microchip wars leave the EU”; Dimitar Lilkov, 2022.

URL: https://euobserver.com/opinion/156355